|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

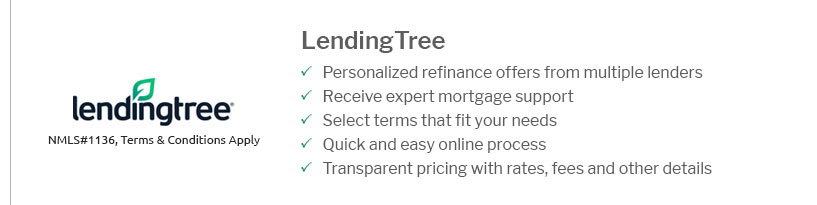

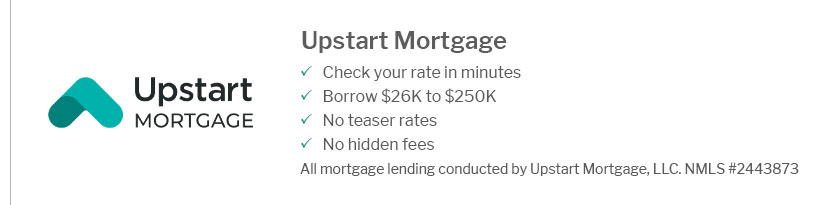

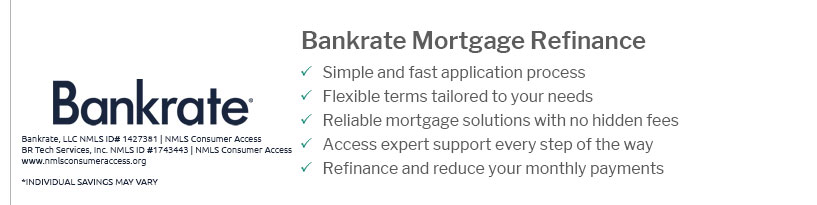

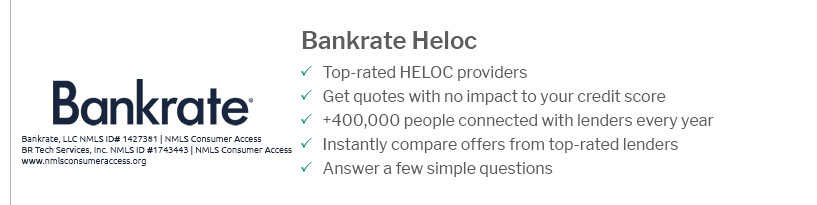

The Best Choices for Top Mortgage Lenders in the MarketWhen it comes to financing a home, selecting the right mortgage lender is crucial. With numerous options available, understanding the differences can help you make an informed decision. This article provides an overview of some top mortgage lenders and what makes them stand out. Why Choose a Top Mortgage Lender?Top mortgage lenders offer competitive rates, exceptional customer service, and a variety of loan options. These features can significantly affect the overall cost and experience of your home financing journey. Competitive RatesOne of the primary reasons to opt for a top mortgage lender is their ability to offer competitive rates. This can save you thousands over the life of your loan. Exceptional Customer ServiceTop lenders are known for their customer service. They provide guidance and support throughout the loan process, making it smoother and less stressful for borrowers. Diverse Loan OptionsFrom fixed-rate to adjustable-rate mortgages, these lenders offer a range of options that can be tailored to meet individual needs. This flexibility is crucial in finding a mortgage that fits your financial situation. Comparing Popular Mortgage LendersIn this section, we compare some of the leading mortgage lenders based on their offerings and reputation. Lender A

For those interested in refinancing, exploring refinance interest rates today california can provide insights into current offerings. Lender B

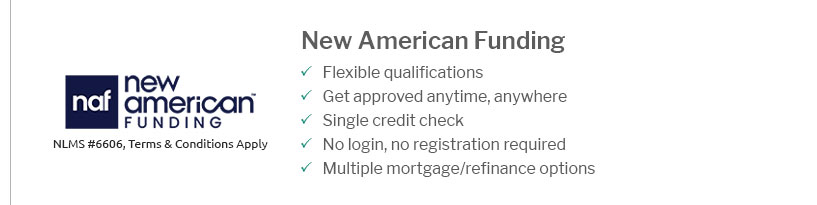

Lender C

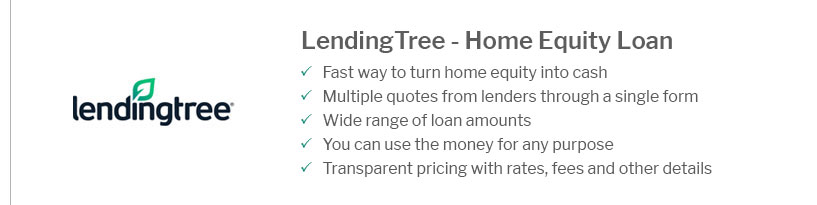

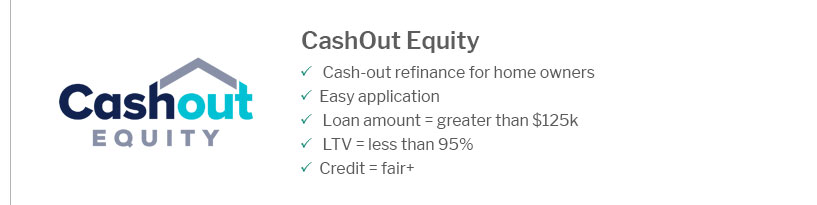

Additional Considerations When Choosing a LenderBesides rates and service, consider these factors when selecting a lender:

If you're considering refinancing, exploring a refinance housing loan could be a strategic move. FAQ Section

https://www.yelp.com/search?find_desc=Mortgage+Lenders&find_loc=Philadelphia%2C+PA

Top 10 Best Mortgage Lenders Near Philadelphia, Pennsylvania - 1. Philly Home Girls. 5.0 (116 reviews). Real Estate Agents - 2. The Durkin Team - CrossCountry ... https://www.reddit.com/r/philadelphia/comments/bg6ytl/homeowners_can_you_recommend_a_good_lender/

Best Mortgage Lenders in Washington State - Best Mortgage Lenders in Michigan - Best Online Mortgage Broker - Best Auto Loans for Bad Credit ... https://www.zillow.com/lender-directory/pa/philadelphia/

Looking for a lender? - AnnieMac Home MortgageNMLS# 338923. 4.97. 7164 Reviews - NewRezNMLS# 3013. 4.96. 6705 Reviews - Meridian BankNMLS# 462854. 4.97. 1455 ...

|

|---|